Should You Sell Your Investment Property Now?

- grace264

- Aug 5

- 2 min read

Updated: Aug 7

Selling an investment property isn’t just a transaction—it’s a strategic decision. The goal is clear: maximize your returns. But before you list your property, there are several factors to consider, such as market trends, tax implications, and tenant situations. That’s why working with an expert is key.

So, is now the right time to sell? In 2025, many investors are asking the same question—and here’s why some are deciding to move forward.

Top Reasons to Sell Your Investment Property in 2025

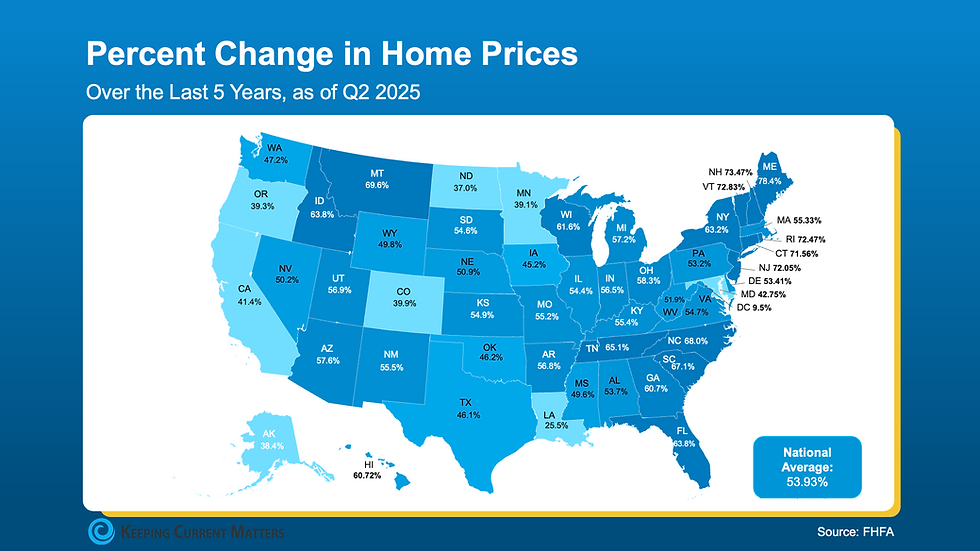

✅ 1. Neighborhood Dynamics Are ChangingIf your area has appreciated significantly and you’ve already captured strong gains, this might be the perfect time to cash out. Conversely, if property values in the neighborhood are expected to decline, selling before a major drop could protect your equity.

✅ 2. Major Repair Costs Are ComingNeed a new roof, foundation work, or HVAC system replacement? Selling now could save you thousands in future expenses. For condos, looming special assessments are a strong reason to consider selling early.

✅ 3. Increasing Tax BurdenIf your investment property is pushing you into a higher tax bracket or tax benefits are about to expire, selling strategically can help minimize risk.

✅ 4. Better Investment Opportunities AheadIf your property has appreciated significantly, it might be wise to redeploy that capital into higher-yield assets—such as multifamily properties or opportunities in emerging markets.

Who’s Buying in 2025?

Today’s buyer pool is diverse. While traditional investors are still active, owner-occupants are also driving demand for single-family homes and townhomes.If the property is tenant-occupied with stable cash flow, it could be an attractive turnkey option for another investor. Or, your current tenant might even be interested in purchasing the property directly—allowing for a quick off-market sale.

Don’t Forget About Taxes

One of the biggest factors when selling is capital gains tax.

Own the property for more than a year? You’ll likely qualify for long-term capital gains rates, which are generally lower than ordinary income tax.

If you’re planning to reinvest, consider a 1031 Exchange to defer taxes on your profits.

A tax professional can help you navigate these rules to protect your gains.

How Much Profit Can You Expect?

House-flippers earned an average profit of $58,000 in recent reports (before repair costs). Long-term investors often see substantial appreciation combined with years of rental income, resulting in a strong overall return.

Tips for Selling at the Highest Price

✔ Time the Market: Spring and summer—especially during interest rate dips—are historically strong selling seasons.✔ Make Small Upgrades: Paint, landscaping, and lighting offer great ROI.✔ Evaluate Tenant Impact: Tenants can help or hinder a sale; plan accordingly.✔ Hire an Experienced Agent: Especially one who understands investment property strategies and tax implications.✔ Prepare Documentation: Rental income history, maintenance records, and tenant details build buyer confidence.

Bottom Line

Selling an investment property is more than just putting a sign in the yard. It’s about strategy—timing the market, managing taxes, and positioning your property for the right buyer. With expert guidance, you can maximize your profit and minimize risk.

If you’re considering rebalancing your portfolio, let’s create a winning plan together.

📞 Questions? Let’s talk today!

Sang Han

📱 773-717-2227

Comments